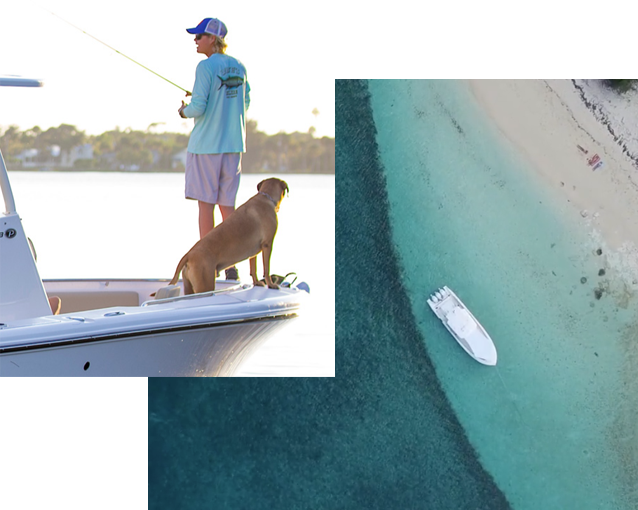

Turnkey Business, Ready-Made for Boat Owners

The Sovereign Boat Fleet is a shared access business that has been set up specifically to make boat ownership more affordable. Owners of new boats need only share access to them through our program. By signing a contract, you’re in business, and the Club manages it for you. This simple act makes you eligible for tax deductions under Section 179, and earns you income generated by the club.

Section 179 of the Internal Revenue Code remains in effect as of 2025. This provision allows businesses to deduct the full purchase price of qualifying equipment and software placed into service during the tax year, rather than depreciating it over time.

Key Details for 2025:

- Deduction Limit: Businesses can expense up to $1,250,000 in qualifying purchases.

- Phase-Out Threshold: The deduction begins to phase out when total qualifying equipment purchases exceed $3,130,000.

- Bonus Depreciation: In addition to Section 179, bonus depreciation is available at 40% for 2025, allowing businesses to deduct an additional percentage of the cost of qualifying assets.

These provisions are designed to encourage businesses to invest in new equipment by providing immediate tax benefits. It's advisable to consult with a tax professional to understand how these deductions apply to your specific situation.

Earn Income with Club Access to Your Boat

By entering your boat in Sovereign Boat Fleet’s program, you can earn income to cover your normal operating expenses – plus, offset depreciation and help pay down the note when the boat is kept in our Club program for the full term. A general example of income you can expect depends on the purchase price, cost to operate your boat and the number of members joining the club to use your boat.

Annual income example based on a $300,000 boat

Note: The example above is based on an annualized basis with the number of members for a full 12 months. The amounts above our not guaranteed, but rather are offered as an example of income that can be made. The boat owner is responsible for all expenses related to the ownership the boat, including storage, insurance and maintenance.

Boat Criteria

- Premium well-equipped brand

- Boat must be 3 years old or newer

- The boat must be available for 4 years

- Location must be within a 30 minute drive of a large population center

- Must be in excellent condition with no encumbrances

- Must be available for inspection

- The original invoice must be available

The most practical ownership program available

Boat ownership is expensive, not only because of the high cost of new boats, but also because of ever-increasing operating costs and depreciation. By entering your new boat into Sovereign Boat Fleet’s program, you'll receive a tax deduction of the cost of the boat commensurate with the Fleet’s use and you will also receive income from members using your boat. This income will go a long way to covering your operating costs and mitigating your boat’s depreciation.

Program Advantages

- Income to cover operating expenses

- Income to mitigate depreciation loss

- Expert 3rd party boat management

- Boat depreciation is tax deductible

- No time robbing maintenance chores

- Active Marketing

- Easy online reservation system

- Boater orientation & training

- Smart utilization of your expensive asset

- Maintenance records for better resale

- Turnkey marketing and management

- The boat owner signs a contract with Sovereign Boat Fleet to allow use of the boat by members in return for payment for member usage. Contracts are on a year to year basis, and boat owners can withdraw their boat’s use at the end of the last member's contract period.

- The Club markets memberships for exclusive usage of your boat for the number of days you specify are available each season or year – however, the boat must be available for at least 50% of the time.

- Club members reserve their boat usage with the Fleet’s on-line reservation service.

- Boat owners receive income from each of the members using their boat, all of which is billed and paid to you by the Club in one monthly check.

- Because your boat is a business, depreciation is tax deductible

- Monthly income based on the number of Club Members

- Use of the boat when not reserved by members

- All member billing and receivables in handled by the Club

- Online reservation system

- Marketing services and sales

- Management of the vessel, including help with securing storage, insurance, and equipment

- Full third-party management services including overseeing and scheduling maintenance, repairs, clean-up, and monitoring of member usage and fuel consumption

- Peace of mind that your boat is being looked after regularly

- With 3 to 4 members, the total annual operating expenses for the boat should be covered by the income paid to the owner.

- Ownership of the boat

- All operating expenses

- Adding certain equipment required by the Club

- A one-time enrollment fee of the boat in the Club

- Giving over management of the boat to the Club on a year by year basis

I’m Interested in Adding My Boat to the Club